I’m attending Responsible Investment Association Australasia (RIAA) #RIAustralia23 and both day’s were packed with a mix of challenge, insight and the occasional moment of raised eyebrows.

It’s also worth noting if we haven’t met before, my job isn’t actually running an interview podcast or doing event reviews, who knew, right?!

My actual work is done with CEO’s, Boards, and Executive Leadership teams, usually helping them to take charge of their investor and stakeholder relations, develop cut-through messaging & get major projects over the line.

For the last 4 projects, that’s included institutional capital raising, HNW, and sophisticated fundraising, launching a Centre of Excellence in Circular Economy for the South Australian Government, and pitching the ex-PMO’s office on a regional and national rollout of a youth mental health intervention.

These included research, business planning, branding uplifts, websites, video platforms, data analytics, sales team training, IM’s, pitch decks, and presenting.

So that’s what’s going on behind the scenes – my team and I build turn-key Investor Engagement Systems® and support people who care, and create change that matters, at scale. I’ve been leading Bravo Charlie for 14 years now, and if you know a growth stage business, investment fund, or significant government project on the go that may need this kind of thing, please introduce me 🙂

So what’s with all the interviews?

I like learning and getting inspired, and I believe for the sake of humanity and our society, we need to be having better conversations with people who are worth listening to. Smarter Impact is my entirely self-funded contribution to this.

Speaking of which, it was great to meet Nicolette Boele in person today, as in the lead-up to the last Federal Election I’d had her on as a guest with Monique Ryan, Julianne Schultz, and Despi O’Connor, promoting our ‘Search for the Soul of the Nation’ – and how great is having a coast to coast Labor Government for movement on climate?!

What follows are my handwritten notes from the day, quotes may be amalgamated for brevity and expediency

Welcome to Country and speaking truth to power

If you’re reading this early I have not yet confirmed this gents name, though I commend him for taking his opportunity to express rancour at the idea that 60,000-year-old custodians needed to seek permission from 230-year-old settlers to have a voice to Parliament about country. Yes to Voice.

20 years of hard work and our ‘Tetris’ moment

Simon O’Connor opened the day’s business speaking to the establishment of the Net Zero authority, decarbonisation, aligning capital with a healthy and sustainable economy and the role of stewardship.

His invitation was for us to get on board, collaborate and shape what’s going to come.

“20 years of hard work to get here, now we’re at the beginning of a massive change. This is our Tetris moment, to ensure the pieces fall into the right place”.

“Through reporting, data and frameworks, with clear product labelling and relevant certifications, we can address the great transition and in turn, the great social challenges of our time.”

“To think we can achieve this is not too great an ask. The 700 people here, are managing the pensions of millions, and assets of trillions”.

ESG – Woke and broke?

Estelle Parker lead us into a fascinating discussion that posed nuanced and considered insights, mixing populism, politics and economics.

Prof. Tim Lynch spoke to ESG being used in the US as a hammer to align the Republican base, similar to abortion rights, and there is no allegory to this in Australia.

In contrast, Jens Peers, CFA spoke to Europe’s alignment on ESG, and the implicit agreement to use the market, not regulation to undertake change.

A further exemplar of this was discussed as the EU’s collectivist nature in looking at portfolios, vs the US’s focus on maximising each stock in a portfolio irrespective of its aggregated impact, and the nod to cultural individualism.

Fiona Reynolds – “Economy serves society – if that’s woke, well so be it. We need to reject the language and not be sidelined by a political take.

Responsibility, materiality, pricing externalities – speak the language of investments.”

ESG is hygiene to EU money. US managers want ESG references removed from documents whilst still doing it.

The impact of the impending US election will massively shift the speed of acceleration in climate mitigation, one way or another.

We need to know, as an investment house, what are your fundamental beliefs. If you want to be a universal investor, you need to decarbonise the economy.

When we look at MSCI benchmarks for the ASX top 300, we are on track for a 4-degree temperature increase. We all burn at 4 degrees.

Tim and Fiona went back and forth on the issue of lobbying, with Fiona calling out corporate lobbying as the issue climate wasn’t being addressed effectively, and Tim pointing out the entire conference was being asked to become lobbyists.

Whilst I personally take his point on the level of a debate, in actuality from what I’ve seen of the fossil fuel industries in my lifetime and relevant examples of lobbyists masquerading under false pretences, I need to stand with Fiona on this.

Jens further cited the prominent backlash to ESG is in countries where shifting to a renewable society targets the economic power base.

“We are not here to make profits out of these gross violations of human rights”

Ross Piper sat in discussion with Tomoya Obokata, after his keynote on modern slavery and his work with the United Nations.

50 million people each day are trapped in modern slavery.

26 million in forced labour and 22 million in forced marriage.

Mr Obokata: “.. Have policies on modern slavery. Do not rubber stamp these. There are easily identifiable high-risk industries for modern slavery. Investigate your supply chain and act. Ask about the due diligence companies you invest in have done. Don’t divest when you find issues. Fix them. An unemployed person will work anywhere to survive. Divestment perpetuates the issues.

Consider the impact on workers first, then your company profits.

Say ‘ We are not here to make profits out of these gross violations of human rights ‘ .. “

Drowning in a Sea of Requests – Corporate engagement from the inside

A substantial lineup; Mark Rigotti, Claudia Chapman, Patricia Cross FAICDLife, Guy Debelle (Fortescue Future Industries) and Simon O’Connor.

It became quickly apparent the session title hadn’t caught on, no one was drowning in a sea of requests from investors. Guy shared that investors aren’t pushing back on claims they were making, and in turn, not enough companies are being asked ‘What are you doing? how will you get there?’.

There is an importance in asking for granular questions that are company and industry-specific, and this requires resourcing.

It’s one thing to make a claim, the question is how do you back it up.

Compliance was a different story, and Mark Rigotti quipped about not bringing the 3,900 pages of the Corporations Act as a prop, as it would have put him overweight on his luggage.

Further in he added that if you want better outcomes, put inspiration into a discussion and that a bank he knows reports to 205 organisations each month – so compliance is a huge undertaking. Things he doesn’t like? Generic questionnaires and learning about investor requests through the media.

For Patricia Cross, Greenwashing pairs up with virtue signalling; “Don’t be seduced into seeking a headline for yourself. Do what’s best for the company”

The team spoke about remuneration, proxy advisors, the stages of awareness, competence and expertise from both clients and industry players and that if you’re a material holder in a business you should be engaged, otherwise you’ve not done your due diligence.

“You need visionaries, and you also need to do things in bite-sized chunks”

First Nations Investment Markets

“The fundamental question is, do we trust aboriginal people to manage money?”

Peter Yu, Leah Armstrong, Benson Saulo and Alan Dayeh presented one of the most powerful sessions in my recent memory.

Peter Yu AM began;

“This is a developing opportunity, not mature. There has always been a common right to negotiate pre or post-native title. Since the Timber Creek High Court decision in 2017, the sky hasn’t fallen in. From a first nations perspective, we are 5% of the global population, with access to 80% of the biodiversity”.

Benson took us through his experience of native tribes in the US, noting cultural variance of language, terms and titles between Australia and America in how we reference indigenous.

Where Australia has Supply Nation(.org.au), in the US their tribes are Sovereign Nations that are economic powerhouses, for example in Oklahoma, with two nations being $10BN and $11BN tribes.

“Where will we be in 7 generations’ time? We must look at who’s next to us, who is behind us and who is in front of us.”

Leah Armstrong spoke about the path to self-determination being the most important thing to indigenous groups. Also that pointing to a gap in investor readiness is about both sides of the equation. Overcoming track record can be done, pay attention to ‘Due Diligence 2.0’.

Peter spoke to the word cloud put to the room “What do we need to do to look at this from a benefit to community and society perspective? What is the value proposition of getting this right for the nation? It is clear from the recent budget, that we exist in a vacuous regulatory context”

Further.. “We operate in an economic apartheid in Australia. In the middle of the richest mineral deposit, probably on earth, the Pilbara, we have a jail full of 99% black faces”

“There is a false economy, the NT runs on welfare payments – in the US the freedom to succeed and fail has been afforded to the native population”

Benson “I started out as a bank teller, even as a teenager, working alongside my colleagues behind the counter, people would come in and when they saw the colour of my skin would stop, wave me on and say they will wait for the next counter to be available. This raises the fundamental question, do we trust aboriginal people to manage money?”

Leah closed the session..

“You can’t have green without orange (gender equality), and you can’t have green without ochre”

The evolution of Impact Investment in an area of sustainable finance

Michael Traill is a bio you’ll need to look up, he’s involved with boards that manage hundreds of billions of dollars and has a name synonymous with philanthropy, he speaks quickly and emphatically, and whilst I’m always engrossed, I can never keep up with the notes.

“You can drown in jargon. And I’ve seen lots of ESG lipstick on pigs” – that was an easy one to note down. The essence of it was his call for values based capitalism. That a clean definition of ‘impact’ is ‘measurable financial and social return, and the $ are risk weighted’.

The focus must be stewardship, ethics and integrity.

Greenwashing in Australia: A view from the regulator

Karen Chester took a few minutes to drop her line that ‘How to avoid Greenwashing’ last year from ASIC was ‘Season 1’, and as of delivering this session which you can read verbatim on the ASIC website under ‘ASIC and greenwashing antidotes’, ‘Season 2’ was out.

If you’re into this sort of thing, ‘ASICs greenwashing interventions’ isn’t that bad as a sequel 😀

I’ll throw a plug in here for the work my team and I did with several industry leaders at the same time late last year, which was a look at regulatory initatives in the UK, Europe and Australia, and housed within a much more attractive season box set, including video interviews!

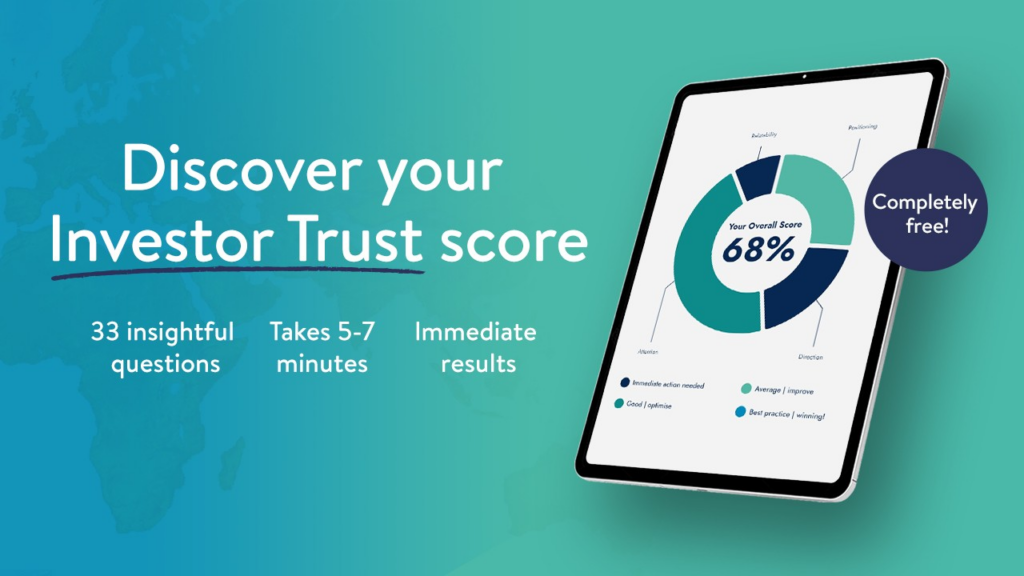

You can get instant access to it by completing the Investor Trust score I mentioned at the start, the link is in the first comment 😀

That said, I haven’t cancelled anyone’s Financial Services license, so high five to Karen and co on that one.

What’s this all about then?

As Karen puts it..

“Greenwashing is a corrosive agent to market integrity.

Three must-haves:

- Transparency through disclosure and a global standard

- Bright lines

- Regulators working together

Misrepresenting environmental impact erodes confidence.

Bloomberg has ESG investments at 52 trillion by 2025, this is 1/3 of all investments.

Looking at 400 companies, we’ve seen an 8x increase in mentions of ‘carbon neutral or ‘net zero’ in price-related communications.

Our quest is to stamp out greenwashing. (Adopting the) ISSB standards are a must-have if Australia is to remain a global home for capital.

Case-by-case interventions are not sustainable at scale, though we are acting to enforce the law.

No regulator is an island, we are working with the ACCC and clean energy regulators.

We are undertaking surveillance of super funds and green bonds.

There is a line between green hushing and making aspirational statements. We look at if these have a foundation.

Do claims have transparency and a reasonable basis?

We want to see everyone set up for success, and the market eliminating greenwashing.

As good stewards of capital, we want to see what representations have been made, and what’s your basis?

Transitioning the ASX – insights & progress towards Net Zero

Nathan Parkin presented Ethical Partners Funds Management by way of three companies they hold positions in, and Sarah Clarke, Naomi Flutter and David Akers took through us steps they were taking towards Net Zero.

The contention and insight were that all 3 are involved in areas that are traditionally hard to abate, being food, the built environment and chemicals, and that looking at the ASX300 MSCI ratings have us on track to a 4.5-degree warming.

Where David spoke to the core mission, purpose and leadership, and investigation of solutions related to methane output, which is interesting considering A2 don’t own the cows or the farms.

I’ll shout out again here to Sam Elsom and Sea Forest again as I did back at the Climate Investor Forum, whose Asparagopsis product for livestock methane reduction/elimination is schmick (and I’m pretty sure A2 are already onto it!)

David took it as almost confusing when posed the question by Nathan, as to whether A2 would be integrating the acquisition of a business into their ESG reporting, as internally they all assumed this went without question – something I found quite comforting from a cultural perspective.

Naomi Flutter’s take on Wesfarmers was interesting, though I’ve got to admit the level of letdown I felt was intense, hearing her say the crux of their aim was reliant on ongoing government investment into Carbon Capture and Storage and this being effective at scale (Honest Government Ad | Carbon Capture & Storage anyone?).

That aside, Naomi pointed to LEAP-FI via the TNFD (acronym overload? Don’t fret it’s normal [Taskforce on Nature-related Financial Disclosures]) and the struggle of drawing a line in relation to what’s dependent on the natural environment and having 20,000 or so suppliers.

In a sense, that we can’t draw a line speaks to us all being interconnected, which is pretty neat, and economically terrifying if you haven’t got your head around limits to growth and finite systems yet.

Sarah Clarke was a force for Mirvac, challenging the room to ask the same question about ESG or climate action throughout levels of their investees, and that alignment would be easily seen in the answers, as to whether vertical integration of culture had been achieved.

Emissions reduction wise, Sarah anecdotally took us through the many areas Mirvac have taken a process and design optimisation approach, for example, pre-fabricating components off-site and delivering them, from large foundation pillars to entire bathroom units. In the latter case, a housing component would take 7 weeks on-site to build and multiple trades, being pre-fabricated, delivered and installed on-site in 23 and even 12 minutes per unit.

Designing incentives for optimal resource usage such as charges for returns of unused material and such were also spoken of.

David added that A2 realised they could have a greater impact using the Capital Expenditure they spent purchasing carbon credits to offset scope 1, 2 and 3 emissions in 2019/20, with investing into technology and emissions reductions in the supply chain. So they are doing that.

Impact or Impactful?

Joshua Edmunds, Kerry Series, Robyn Parkin, Kylie Charlton and Amanda MacDonald went at it for the last session I attended for the day.

Looking back on the session title, I should have known this was a setup, because I’ve spent a lot of time around Impact Investing conferences over the past few years, and predominantly having Impact Investors as clients for Bravo Charlie, I was getting a little incredulous at hearing the word impact used in as close to as adjective as you could get, rather than an investment taxonomy.

I nearly expected Karen Chester to burst through the door proclaiming loudly ‘Now what did we just talk about?!’ .. okay jokes aside;

Kylie Charlton provided a lot of the contextual groundwork for the session, as Australian Impact Investments are both pioneers and leaders in the Impact space, sharing things such as:

“.. Impact Investing is a term coined in 2007.

There is growing momentum ($30BN AUM, 25x since 2015, 10% year on year).

Impact Investing is less than 1% of Responsible Investing.

Impact Investing is a lens, not an asset class – it’s no longer an allocation.

Government and philanthropic capital is not enough to meet our societal and environmental challenges, private money must fill the gap.

Kate Raworth, Doughnut Economics, is well worth your time.

Impact is a third dimension to risk and return.

There is a pervasive myth that impact is concessional. It is not.

Scale without integrity is nothing.”

Kerry was alight with his passion for the change companies in the NorthStar Impact portfolio are making, from education to regenerative food and agriculture, and how he started NorthStar because he simply couldn’t find anyone doing what he wanted to do with his money.

He spoke to the focus on Additionality (alongside Intentionality and Measurement) and “extending and scaling impact” – “Q. How can we help them do more?”

One idea he floated is “Why don’t we have a corporate tax rate that varies, and is lower for those doing good, and higher for those harming the social fabric?” – makes sense to me.

Robyn Parkin made the excellent point that every dollar spent has an impact, and in the context of the Responsible Investing Summit and those managing our national and global pensions being in the room, it really does hold weight.

Robyn also pointed out the grim reality that only 12% of the UN Sustainable Development Goals are on track. Even with the GIIN & PRI’s work, there is rapidly increasing cynicism about ESG.

Amanda MacDonald spoke about “the challenges of researching scalable solutions will serve most” and the demand of clients who are “returns first”, and more so, their demand for confidence in their advisers. Reasonable, though a tall ask finding market opportunities for this trifecta.

Or is it? Can the perfect “impact” portfolio exist? No.

The long answer posed by Kylie Charlton went something like this;

“.. Start any sentence with ‘But for my capital.. would this make an impact’ ? “

If a particular business didn’t have your money, would it matter, would they make less difference in the world? For example, trading listed equities and expecting that to make an impact. It doesn’t. You buy someone’s shares, the company doesn’t get any more money.

You can have an impact across your portfolio, though different industries and sectors will have different levels of impact.

***

Firing himself up to lay down the challenge, Kerry closed the session speaking of the $4 trillion gap to reach the Sustainable Development Goals (SDGs), which is less than 1% of global finance, and thus;

“When we look at carbon in the atmosphere rising, social inequality rising, and health care going down, is “Responsible Investing” impactful, or an excuse for business as usual?

Day 2

Quotes are from my handwritten notes, and potentially abridged and amalgamated for brevity’s sake.

So Meta – Tech and human rights

Min Wah Voon, Head of working groups at RIAA set the scene, referencing Geoffrey Hinton, the ‘Godfather of AI’ resigning over the direction AI was taking.

Likening his position to the approach a lot of humanity took towards nuclear weapons, and that by over-reacting we avoided the potential impact of nuclear war, a similar trajectory would be better for humanity than letting these digital bombs go off unchecked.

Things really got going when the eSafety Commissioner of the Australian Government, Julie Inman Grant was asked about what she was concerned about;

“.. The convergence of systems is a worry – Haptic suits and immersive technology, being sexually abused in a cyber world could have physical repercussions in the real world, deep fake porn.. there is a lack of guardrails in general – we are creating poison without its antidote, and post-fact ex-ante regulatory control will be ineffective..”

Professor Nicholas Davis, Emergency Technology at the University of Sydney, spoke to 150 large companies about their usage of AI internally, 2 of these had AI plans and as he put it “I believed one of them” – anecdotally we heard a story about the confidence of one CEO who answered proudly how they had solved gender bias in their algorithm, and after being questioned in an excited and nerd like way by the professor, brought his CIO in who confessed it was a nightmare and they were having huge problems with it..

Julie (eSafety Commissioner) took us into the positives of technology, and how when she joined Twitter at the time of the Arab Spring, she saw how technology could democratise speaking truth to tower, though this large data set of interactions also brought up some disturbing realities;

- 1/3 of professional Australian women are subject to abuse online, of a sexual and violent nature

- Adult indigenous users are twice as likely to experience abuse online

- First Nations youth are three times more likely to experience abuse online

In short, Julie maintained that when it comes to the power of technology and discussion “.. Tension is good, but balance is important.”

***

Liza McDonald, RIAA Board Member and Head of Responsible Investment at Aware Super, offered that these days every company is a tech company, and to consider material vs opportunistic risk when considering AI.

Liza offered the EOS Digital Rights Principles as a valuable consideration, and that investors must challenge their investees on their AI governance, as there are potentially huge consequences in how companies maintain their social license to operate in the chance of a data breach.

” Ask your investees: Q. How do you calculate a loss of trust? “

***

Nicholas had a simple statement about the usage of things such as Chat-GPT;

“Anything you put through a browser is insecure. If you paste in client data that is likely a legal breach. When it comes to ChatGPT, do the Sydney Morning Herald Front Page test, ask yourself ‘would I want this printed on the front page tomorrow?”

Where is AI doing wonders? Nicholas pointed to Zipline, the medical supply inc. blood drone delivery company that uses AI to fly around countries. Check out Mark Robers 20M+ viewed video from a month ago, ‘Amazing Invention- This Drone Will Change Everything’ if you don’t know what we’re talking about.

***

Julie pointed us to the 4R’s of digital:

Reputation, Regulation, Revenue and Retention – she took us through the implications of the January ’22 Online Safety Act, the systemic transparency tools that were in place, and anecdotally how some companies are able to analyse and report on child abuse in live stream video in 4 minutes, and some are doing it in 19 days. There is work to do.

***

A discussion was also had about the human impact and exploitation of workers in the global south, with things such as content moderation (scanning millions of images and videos, for example of pornography, looking for violence or abuse) or simply labelling of AI data.

***

The panel gave us some excellent places to learn more:

- The NSW AI Assurance Framework, not perfect, though a good start

- The Secure Board (Book – Anna Leibeil and Claire Pales)

- Global Online Safety Regulations Alliance

- The Atlas of AI (Book – Kate Crawford)

***

Nicholas made a salient point ..

AI is not the wild west. There are so many existing regulatory frameworks that Australian’ businesses exist within;

APRA, Discrimination Law, Privacy Law, Tort and Negligence, Healthy and Safety, and even the ACCC are looking out for misleading conduct.

..and left us with a somewhat more chilling one;

“Governments can’t compete with the private market for the talent needed to make this (AI security) work”

Australia’s Sustainable Finance Taxonomy

Why are we creating an Australian version of a Sustainable Finance Taxonomy?

It’s a good question that seemed well justified by the panel, though potentially at odds with rolling up to a global framework (and one of the reasons I love what Pathzero is doing, and grilled them on how they input and aggregate data, which you’ll read later.)

Charles Davis, Managing Director of Sustainable Finance & ESG at CBA spoke directly to this, calling for unified taxonomy when he is seeing banks develop their own.

Europe’s issues in labelling between green and brown products, and mobilising capital to the necessary transition were cited as a reason for our Australian taxonomy, though interestingly and quite validly jumped on by the moderator Linda Romanovska, member of the EU Platform of Sustainable Finance;

“Taxonomy is a living organism – we have to start somewhere and these issues are clearly identified – the EU has 27 member states that need to agree”

Sybil Dixon, Head of ESG at Vanguard gave positive light to the work, speaking of the taxonomy as a tool for the government to allocate capital, also warning against needing a translation booklet to work with taxonomies in different markets.

Kristy Graham, CEO of the Australian Sustainable Finance Institute, spoke about the work of the last 10 months, and the importance of getting the foundations and governance right, not racing ahead to label things that then need changing.

Kristy detailed the key points of the recent ASFI 2nd paper ‘Designing Australia’s Sustainable Finance Taxonomy’, including;

- Core principles of credibility, usability, interoperability, prioritisation and impact

- Underpinned by internationally recognised, credible, science-based technical screening

- A transition category and traffic-light colour coding for green, transition and excluded activities

- Robust and transparent governance

- Mandatory taxonomy alignment for sustainability claims to address greenwashing

- Developing climate change mitigation criteria as the most urgent priority

What’s on the label? Industry and regulator efforts to combat greenwashing

Susan Quinn, Head of Policy and Advocacy for RIAA led the session:

Q. How can you avoid ASIC attention? A. Leave the country.

Mark Bland, Partner at Mills Oakley quipped in response to the question, though with a wry smile, it belied a much more important point about the scale of attention our national regulator is paying to what people are saying.

He framed it another way in regards to company conduct; Complete the sentence “How can you call yourself a steward if.. “ whatever your investee or company may be doing.

“Can your claims be considered misleading and deceptive conduct?” ASIC wants to know if you have credibility and believability in what you’re promoting.

Some key points I noted:

Funds have operated under undefined regulations for a decade. This is changing. Where Europe intended the Sustainable Finance Disclosure Regulation (SFDR) to be a regulatory tool for operators, the market used it as a labelling mechanism.

– Kuldeep Yadav, VP of ESG & MSCI

It’s simple. We can’t have a fund say something and not do it.

– Hari Balkrishna, VP of T. Rowe Price

In Europe they are looking at fund names, if you have the word ‘ethical’ or ‘sustainable’ in your name, then over 80% of your portfolio must align.

The point of the regulator is that things do what they say on the tin.

Divestment as a strategy has been proven to not work. Ultimately if we keep handing over things rather than transitioning them, we will end up with Aramco owning all fossil assets.

– Susheela Peres Da Costa, Principle at Stewardship Centre

This was interestingly contrasted by a panel member talking about the market engine of making renewables more cost-effective than fossil fuels as a way to transition.

Susheela made the call to conference participants and companies;

It’s incumbent on us to make things understandable. We need them to be basic and factual.

Don’t use adjectives in describing things, only nouns.

Mark spoke further to rating agencies as regulators, keeping in mind that ratings are opinions, and if you have an opinion and no license, see a lawyer.

Hari offered this useful insight;

Impact Calculators always fail. They ignore negative externalities over time.

Pathzero

I spent some time with Carl Prins and the Pathzero team, and it was fascinating to see the effective way they are bringing data together, as we converge into this information being critical if not mandatory;

“.. rapidly generates a PCAF-aligned estimate of financed emissions across your investments using readily available company information..”

“.. Access an estimate of corporate emissions across your operations. Use this information to quickly understand your emissions profile and take a risk-based approach to decarbonisation.

Improve and refine your carbon information by uploading any previously calculated carbon data before leveraging Pathzero Clarity’s state-of-the-art calculation capability to generate audit-grade carbon information across scope 1, 2 and 3 emissions..”

Great stuff, definitely one to watch!

Thanks for reading, there was much more going on at the 2nd day of the Responsible Investment Association Australasia (RIAA) that I didn’t capture here, though I hope you enjoyed this brief observation.

If you haven’t done so yet, take 3-5 minutes to Discover your Investor Trust Score, and see how you perform across the critical dimensions the world’s leading businesses & investment funds score highly on! It’s a new tool I’ve just launched and I’m confident you will find the results highly valuable.

Recent feedback on the Investor Trust Score

Incredibly simple to use, though delivers really impactful insights. I especially love the segmentation of the key factors that determine trust.

– Dickie Currer, Startup Victoria & AirTree Explorer

Genuinely insightful questions.

– Dr. Jodi York, Chief Impact Officer, Kilara

Tools like this are critical to help build your credibility at a time when there is increasing competition for global capital.

– Peter Castellas, CEO, Climate Zeitgeist

Very useful! This has focused our efforts on key areas that will improve our messaging and outreach. Also great for our marketing and comms team.

– Rob Waterworth, CEO, FLINTpro